Shift4: High Risk High Reward

Shift4 (FOUR) is an interesting stock. It works in one of the largest markets in the world, which is payment processing. This market is characterized by a vast number of smaller regional and local players.

Payment processing revenue is very correlated to the economy’s performance, especially the growth of real income per capita. The evolution of the previous variable is uncertain in the future. AI implementation might reduce real income, increase it or make society more unequal.

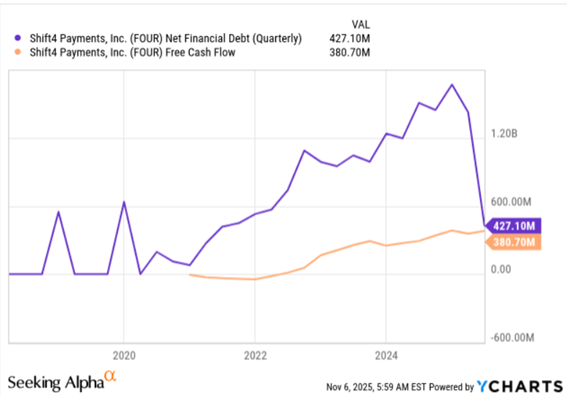

Nevertheless, this industry, because of its decentralized nature, is attractive to execute M&A. This is the Shift4 strategy, using leverage to buy payment processing companies that also add intelligent capabilities or good sales teams. Then paying the leverage with strong free cash flow. The company is focused on conservative spending on opex. In turn, generating strong profitability that pays its debt and stock issuance investment.

For now, I would consider Shift4 strategy well executed. The company shows good capital allocation. It doesn’t overpay for acquired companies, while maintaining strong revenue growth with strong margins across the years.

But intensive acquisition strategies have problems. Integration between systems and companies sometimes doesn’t work as planned. According to McKinsey research, more than half of acquisitions don’t add value to shareholders. Additionally, research shows that multiple smaller acquisitions focused on new capabilities usually outperform large and complex mergers. This is called programmatic M&A.

Evaluating FOUR’s acquisition performance, I would say they fit more in the programmatic M&A category rather than acquiring very large companies in new markets.

Despite attractive industry and good capital allocation the company’s stock has been drifting

Shift4’s price has been decreasing in the past year. Currently the price is around half of the 52 week high. Shift4 made a very large acquisition with Global Blue. One that defies the programmatic M&A strategy. But it also adds very interesting capabilities and cross-selling opportunities.

Global Blue provides TAX refunding services, targeted at luxury franchises. A tourist that goes to France and ends up buying a Gucci bag could use Global Blue’s digitalized TAX funding receipts to get the consumption tax back.

Global Blue also provides currency conversion solutions. This allows customers to pay in their home currency at a hotel, for example.

According to the company earnings and conference calls, Global Blue works in a duopoly industry having only one big competitor. The acquired company is growing at a very fast pace as well, providing a boost to Shift4’s business.

However, as we have seen in the previous, this acquisition wasn’t well received by Wall Street. Shift4 has also been reporting earnings below consensus, further creating a negative environment around the stock.

I believe that Global Blue’s acquisition makes Shift4 enter the merchant luxury segment where it didn’t have a lot of presence. I strongly believe it’s going to be hard for Shift4 to cross sell its payment processing solutions to more than 400 thousand merchants in Global Blue’s luxury network.

Maybe in Global Blue’s hotels it will have an easier time cross selling, because Shift4 has one of the best ecosystems for hotel payments and software. In fact, FOUR boast hundreds of integrations across its ecosystem, especially effective in the hotel segment.

But in merchants like LVMH, it should be important more specialized solutions for luxury, which Shift4, due to the complex integration problems and diversification should lack.

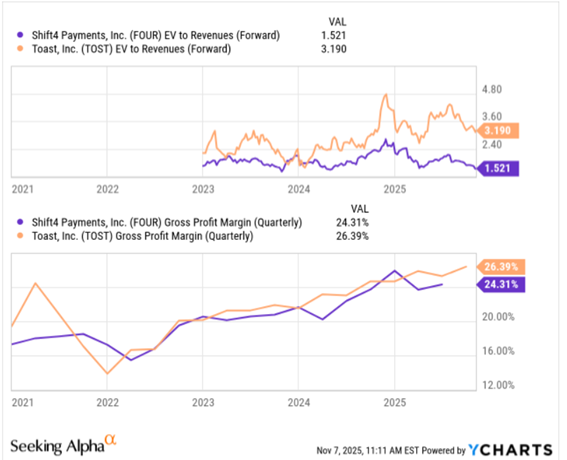

Compared to Toast (TOST), which sells to restaurants POS, hardware and payment solutions, having presence in a lot of US Michelin rated restaurants. Shift4 grows by diversified acquisitions while Tost grows organically with the quality of its solutions.

I would assign a higher premium to Toast’s strategy than Shift4’s, and the market agrees with me.

Buying FOUR is almost the same as engaging with a mutual fund to manage my money. And by acquiring companies at such a fast pace, the headcount increases, there is more difficulty managing and keeping things structured.

This is a major risk for Shift4. Growing so fast with acquisitions might produce below average quality products and systems. Nowadays, with AI disrupting almost every industry, having a stable and core R&D center focused on lower amount of priorities, like Toast, might bring more resilience to the business.

Shift4 is managed with low stock-based compensation. However, its interest payments are significant.

The company is conservative in its investment approach. Its yearly free cash flow clearly pays most of its net debt. This shows that despite the numerous acquisitions, Shift4 has been performing well.

Looking at the gross margin, we have seen a slight dip in Shift4’s metric. Toast is showing higher gross margins.

Toast’s non-cash items are much superior to FOUR’s. Non-cash items encompass stock-based compensation among other items like Goodwill impairment. In Toast’s case this metric is much higher because the company invests heavily in its workforce, while Shift4 doesn’t invest as much. This is a reason for Shift4 being more shareholder friendly but affects them in retaining such expanding and dispersed workforce.

Valuation

Both companies are expected to grow by more than 20% in the next two years. Toast has a slightly superior multiple because of a heavier component of SaaS revenue, higher cash returns on employed capital and a less risky strategy.

Despite Shift4 being cheap, I like to start large relative positions in the companies I invest in. So, Shift4’s grow is very unpredictable, its heavy acquisition strategy could be building a lot of tech debt that gets forgotten due to large inorganic growth.

Overall, it is a risky proposition. I consider it a high risk but high reward position in the next two years. Due to the high risk, I stay on the sidelines.

Conclusion

Shift4’s management and founders found a very niche strategy that works well in the payment processing industry. The strategy has been the same for the past ten years and it shows good free cash flow yields on the money invested. Thus, Shift4 management has been executing very well.

The question is whether they will be able to keep executing in the next years. And if the build up of acquisitions is not creating so much tech debt. The focus is also diversified further affecting product quality and maintenance.

Just like Warren Buffets’s Berkshire, as Shift4 grows there will be less interesting acquisitions that move the top line. This is also another risk for revenue growth contracting in the next few years.

I rate Shift4 cheap but a hold.